Each one of us is unique and we have our own aspirations. Identify your dreams and bring them to reality. Let your hard earned money help you fulfill your dreams. This is exactly our mission - to mentor and coach you so you can make your own financial decisions confidently and live a fuller life!

Our services include financial planning and investment portfolio management. We focus on providing our services to individuals and families. We are very passionate about financial planning and what it can do for a client's future success. We keenly listen to our clients and internalize their aspirations and challenges. In the planning process, we also evaluate scenarios that may adversely impact their future goals and provide contingency plans.

At Trillium Square Advisors LLC, our mission is to identify how our clients can fulfill their needs and desires. Our role is that of a mentor and coach, empowering our clients with information, tools and analytics so they can make their own financial decisions confidently. We are their guide advising them on the pros and cons of a decision they are about to make.

We want to hear your story and get to know you. We also want to understand your current situation and the burning questions you have so we can best help you. We fully support your need to be in control of your life and finances. We are on your side and will guide you along your journey.

We are a registered investment adviser (RIA) in the State of North Carolina. We have a fiduciary duty to act in the best interest of our clients. This is the highest legal standard of care one party can have to another. We are an independent RIA firm which means we only work for our clients, and not for any brokerage firm. We are a fee only firm. Our fees are very transparent and you can find them in our Form ADV which is included in the Resources section of this website.

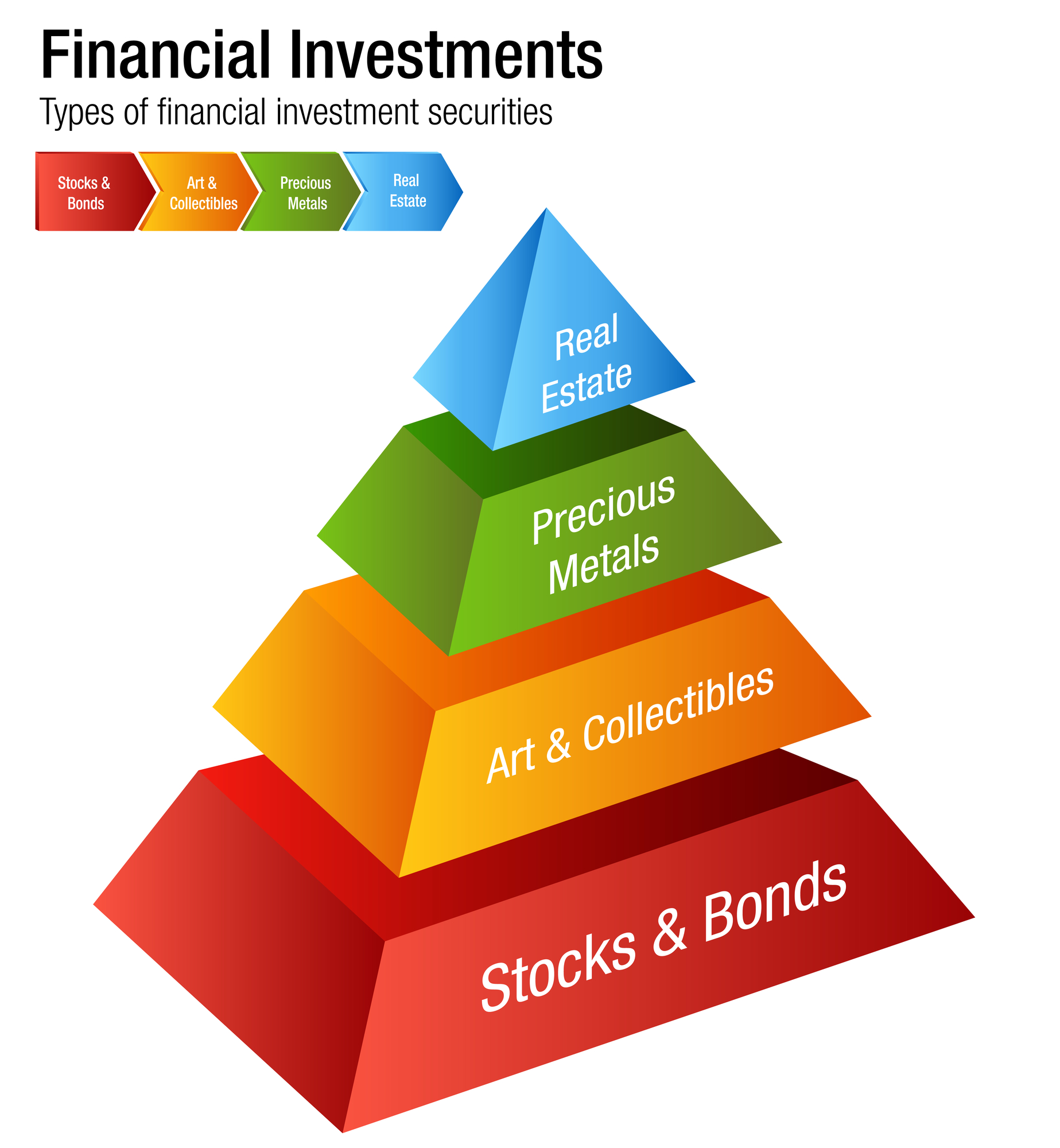

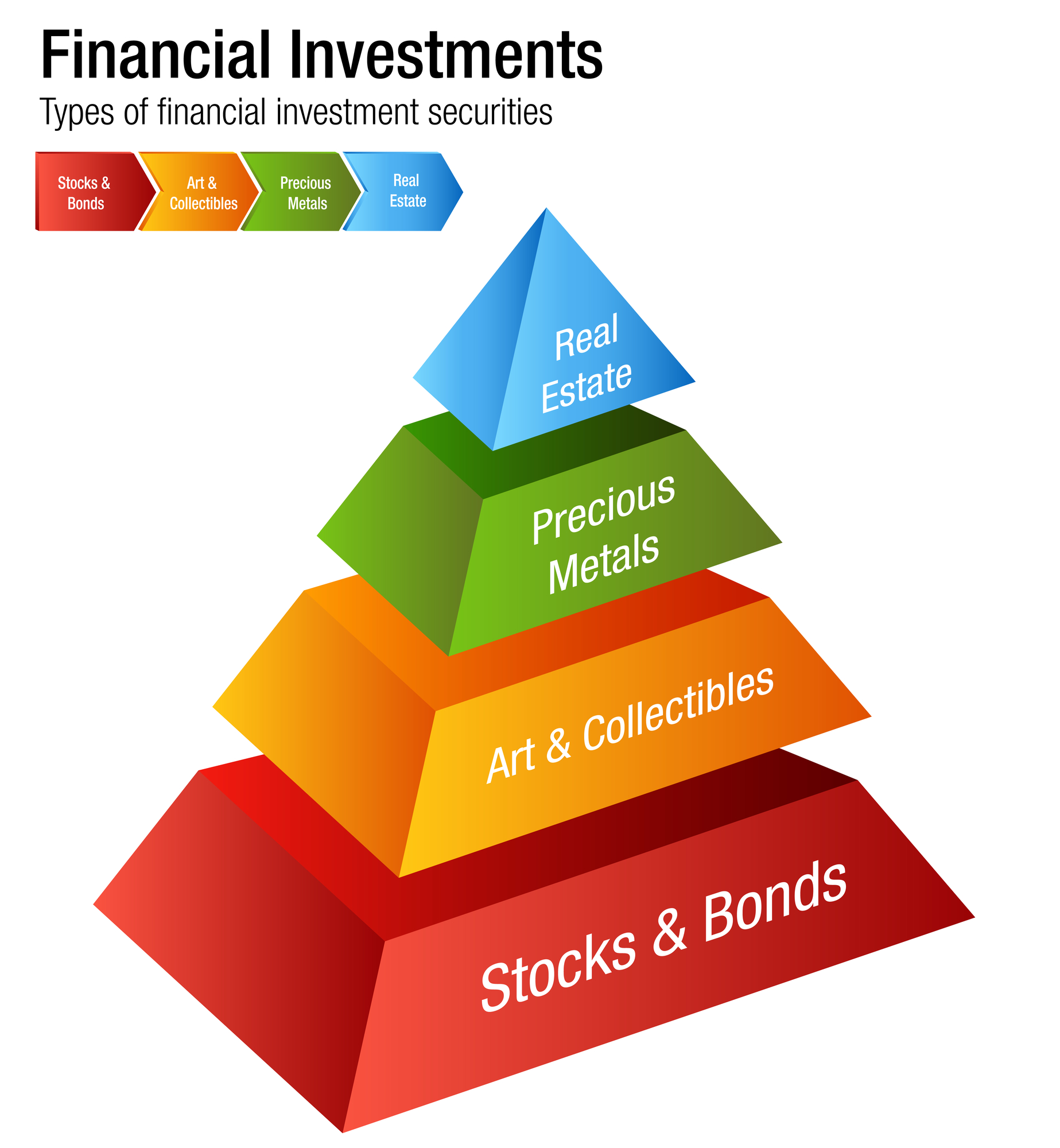

We provide a systematic and disciplined approach to managing investment portfolios. The investment strategies are data driven and quantitative. We regard risk management with utmost importance.

We manage your investments through your brokerage or IRA accounts you have with a custodian. You will grant limited authorization to us to buy and sell securities in those accounts. Your account and security positions in the account are transparent and visible to you at all times.

Our investment portfolio management includes

One effective way to save your hard earned money is by saving them in college savings funds for your kids. These savings have certain tax benefits.

Typically, college funding needs come earlier than your retirement needs. It is essential to set aside some savings every month to build up the necessary college funds for your kids.

You may start as early as in your 20s or 30s towards this goal.

When you retire and you cease to have any income from your job, the money you have saved thus far goes to work for you.

It is important to save a sufficient amount during your working years so that you can live a financially independent life in your retirement.

No matter how close or far you are from your retirement, we will work with you to assess your retirement readiness and help you prepare for your golden years.

The real value of your income and investment returns is governed by the amount of taxes you will pay on them.

Thus maximizing your financial well being includes taking a closer look at how your after tax income can be maximized.

We will work with you and your accountant or tax attorney and understand the impact of taxes on your current and future income.

We will also make recommendations on the types of investments to be owned in the different types of accounts you may have to derive higher tax efficiency.

Being prepared for the unexpected is the hallmark of great planning.

We will work with you to identify potential risks to your financial well being and will evaluate necessary insurance you may need to consider.

In running a business successfully, planning is everything. So is it in retirement. If you are a business owner, there are several advantages to plan for retirement through your business.

At Trillium Square Advisors, we work with your business to identify the right retirement plan for you, the owner, as well as your employees. We are your fiduciary partner and will guide you in establishing and managing the investments in the plan.

We work with multiple Third Party Administrators depending on your business needs.

Typically, small business owners have most of their personal wealth tied up in their own businesses. Thus it is important to know the value of your business to really know your net worth.

Whether you are looking to acquire another business, sell your business or plan for succession, it all starts with knowing the valuation of your business.

If you are a young and energetic entrepreneur looking to grow your business, knowing the valuation today will guide you on how best to spend your energy towards effectively growing the business in the future years.

In a merger, acquisition or succession process, Trillium Square Advisors will be your trusted advisor watching for your best interest during the transaction.

Succession Planning is a process for identifying and developing new leaders whom you can one day delegate all your business activities and responsibilities while feeling confident that your business is in good hands.

Whether you select the new leader from the ranks, family or outside, Trillium Square Advisors will be your financial guide watching for your best interest through the entire process.

We provide a systematic and disciplined approach to managing investment portfolios. The investment strategies are data driven and quantitative. We regard risk management with utmost importance.

We manage your investments through your brokerage or IRA accounts you have with a custodian. You will grant limited authorization to us to buy and sell securities in those accounts. Your account and security positions in the account are transparent and visible to you at all times.

Our investment portfolio management includes

We at Trillium Square Advisors LLC have extensive experience evaluating financial markets and investments. Our goal is to utilize this expertise in meeting the unique needs of our clients.

Our practice is led by Sukesh Pai. Prior to founding Trillium Square Advisors, he served at QMS Capital Management LP and Morgan Stanley & Co. He is a holder of the Chartered Financial Analyst ® designation and has an MBA from Duke University where he was a Fuqua Scholar.

He started his career as a Software Engineer at Microsoft and holds a Computer Science & Engineering degree from Indian Institute of Technology (IIT), Bombay.

Sukesh Pai, CFA

PrincipalMichelle Davis has a background in corporate accounting, public accounting and taxation with nearly ten years as a Revenue Field Auditor at the NC Department of Revenue. She is a licensed Certified Public Accountant (CPA) and is currently pursuing a Certified Financial Planner (CFP®) certification, having passed the November 2021 CFP® Exam. Additionally, she is also FINRA Series 65 licensed.

Michelle is a second career accountant having started her career in hospitality, and her first degree is in Science. She is an active volunteer with the NC Council on Economic Education and the NC Association of CPAs.

Michelle Davis, CPA

Associate PlannerAnanya Mishra is a Financial Mathematics graduate student at NC State. He has previously worked as a data analyst in firms consulting on public finance and has worked in managerial roles with the largest lender in India in various segments like retail, small businesses and agricultural financing. He has also worked with fintech start-ups as a Quantitative Advisor on products and strategies. Having a Masters in Operational Research, he has academic and professional experience in software programming in R, Python and SQL, optimization techniques and statistical modelling.

Ananya Mishra

Quantitative Research Intern

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Trillium Square Advisors LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

This website may provide links to others for the convenience of our users. Our firm has no control over the accuracy or content of these other websites.

Advisory services are offered through Trillium Square Advisors LLC; an investment advisor firm domiciled in the State of North Carolina. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute.

Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant to an applicable state exemption.

For information concerning the status or disciplinary history of a broker-dealer, investment advisor, or their representatives, a consumer should contact their state securities administrator.